Structural Defects Insurance – is it the silver bullet to address defective construction and improve consumer confidence?

The NSW government has recently approved the use of structural defects insurance (SDI) for builders and developers in lieu of the 2 per cent bond required on high density development projects. This means that a private sector insurer accepts the risk associated with repairs of defects for a period of time (2-10 years) post completion. There are a number of considerations for contractors, developers and potential purchasers as to whether a SDI policy is in fact a better solution than the 2 per cent bond and the statutory requirements under the Home Building Act (HBA).

Firstly, SDI is not a “new insurance product”. It has existed and been available in the Australian market since the 1980s. In NSW, private insurers provided home warranty insurance to high rise developments until 2002, when they pulled out of the sector due to continued significant losses on their portfolios. At that time SDI was touted as a potential saviour for the industry, but there was very little incentive to take the policy, and as a result very few policies were incepted.

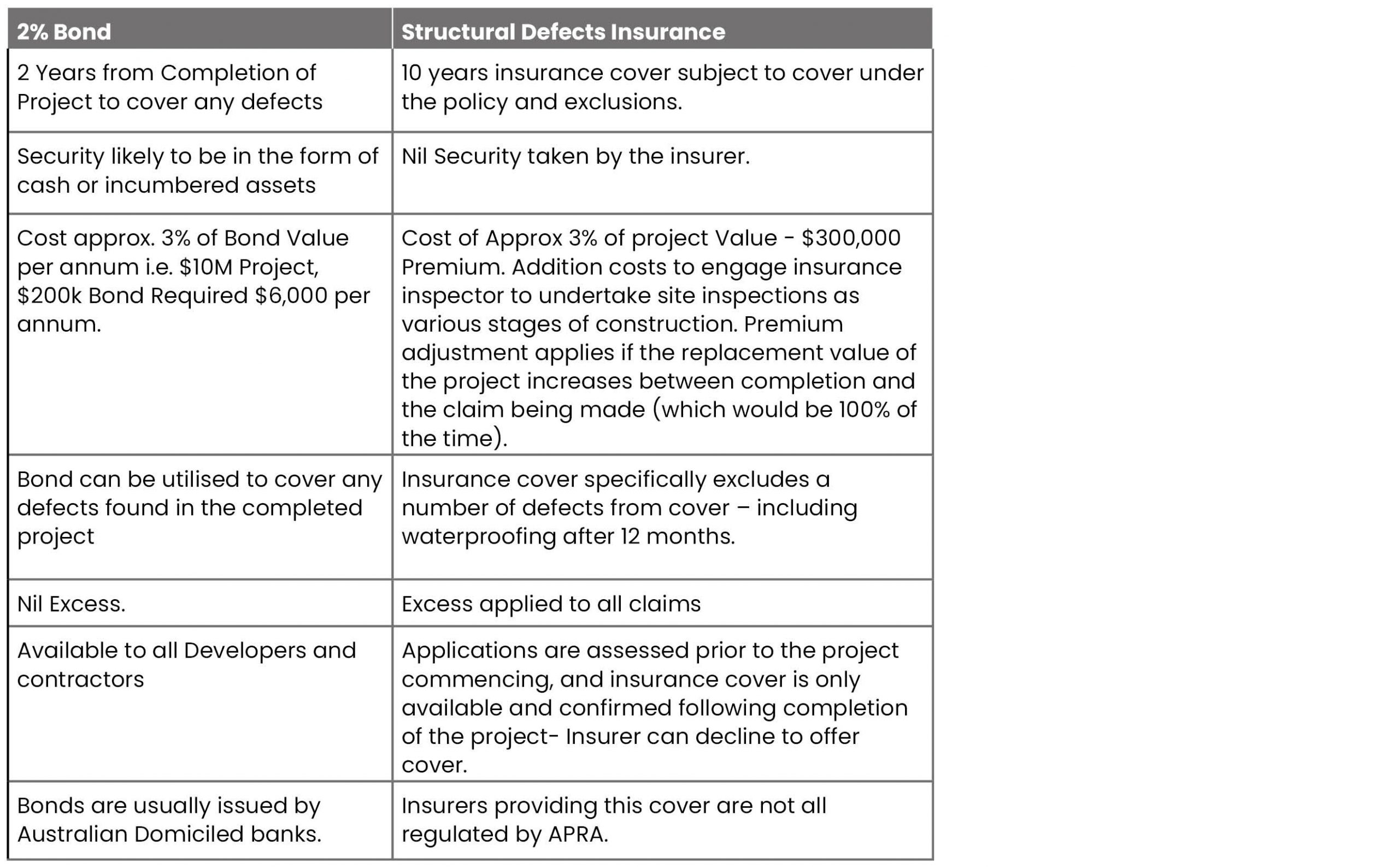

There is now more interest in the product due to the impost of a 2 per cent bond on completed projects, and the ability to swap out the bond for an SDI policy. We flag the following observations as between the bond and SDI:

Based on the above, it is clear that a bond provides protection at a much lower costs. Whether it provides better protection is dependant on the circumstances of the loss – in some circumstances the SDI will provide a great deal more cover (up to the building sum insured) but in other cases the defect bond may prove to be enough. SDI does enable developers and contractors to transfer the potential costs of defects off their balance sheets. However, they still have continuing obligations under the HBA so all risk is not transferred by the utilisation of this product.

There is no doubt that there has been a great focus on inspection and enforcement by the office of the building commissioner. Contractors are on notice that poor behaviour will not be accepted, and the willingness of the commissioner to publicise those contractors who do not meet his standard is likely to increase consumer confidence more than structural defects insurance cover will.

Consumer sentiment is critical to the continued success of development projects and improved perception of apartment living. For many people the purchase of an apartment will be their single biggest purchase, and they want to see the value of that asset improve over time. It is therefore critical that the NSW government continues to look for ways to lift both the perception and reality of quality construction in NSW. In summary these developments complemented by financial assessment, iCirt ratings, licencing, compliance and enforcement of regulations (refer to our recent article on reforms to NSW construction legislation here), certification and inspection of completed projects prior to occupation can all assist sentiment. Local Councils and industry bodies have a part to play and need to also ensure that consumers can be confident of the finished product. Insurance whilst complimentary cannot be viewed as the silver bullet many are suggesting it may be.

It will be interesting to see whether there is a preference for SDI in lieu of a bond. It will be interesting to see how easily SDI can be obtained by contractors and developers, and it will be interesting to see how claims outcomes are improved where this product is used.

Should you have queries in relation to Structural Defects Insurance or managing defects in Strata properties do not hesitate to reach out to Bellrock to discuss.