January 2024 Market Update – Claims

The 2023 calendar year saw a period of unprecedented growth and activity for Bellrock’s Claims Team. Some key statistics from this period include:

- Over $67,156,853.69 in claims currently managed by Bellrock Group.

- An average of 42 claims settled on behalf of Bellrock Group clients per month.

- A total of $29,482,262.18 in claims settled across all insurance classes by Bellrock Group over the past 12 months.

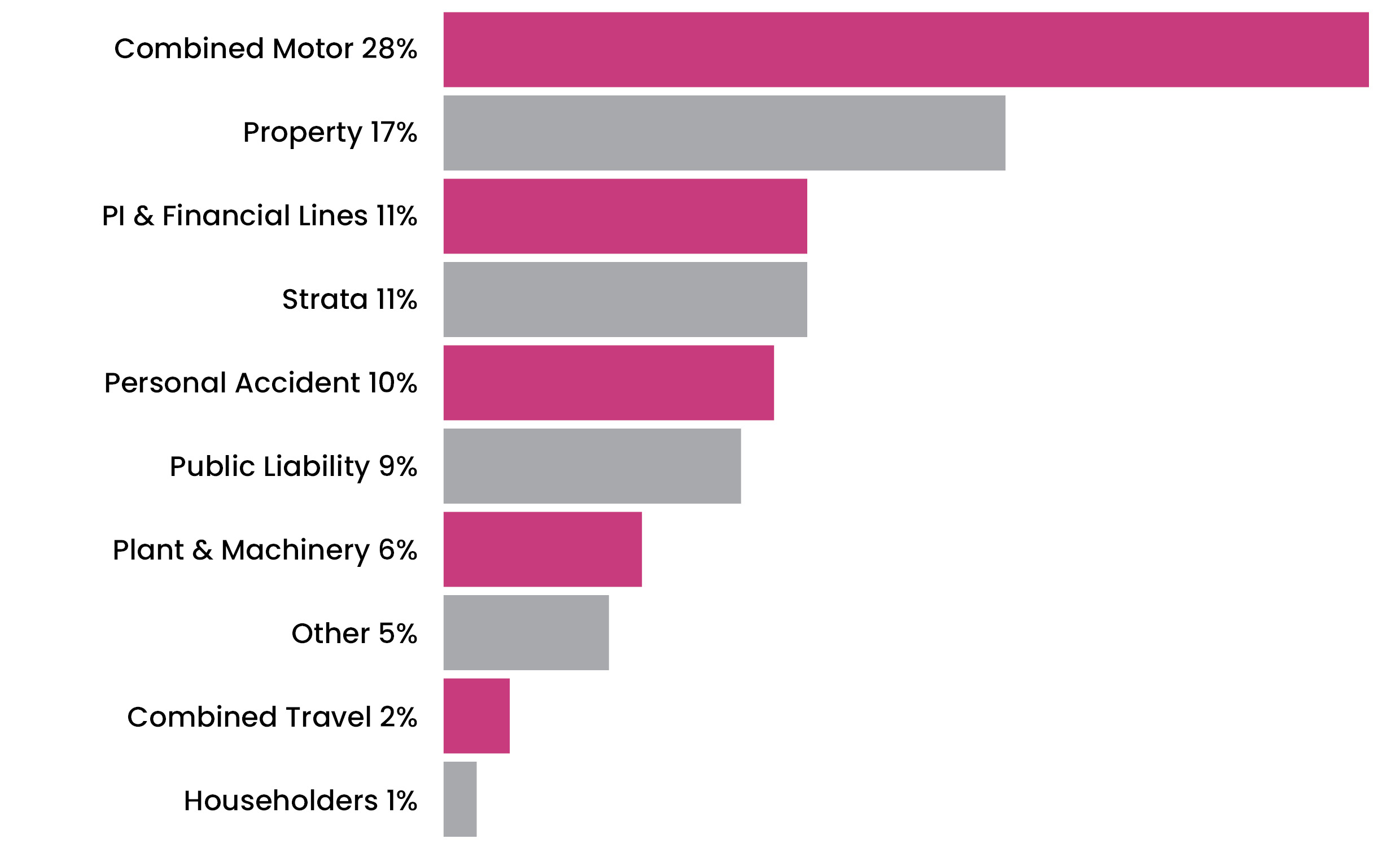

Over the last 12 months (as at 14 December 2023), the Bellrock Claims Team has assisted and advocated for clients, resulting in settlements and payments totalling $29,482,262 apportioned respectively across the following classes, as shown in the graph below.

Number of claims settled by policy class, 2023 calendar year (Bellrock Group)

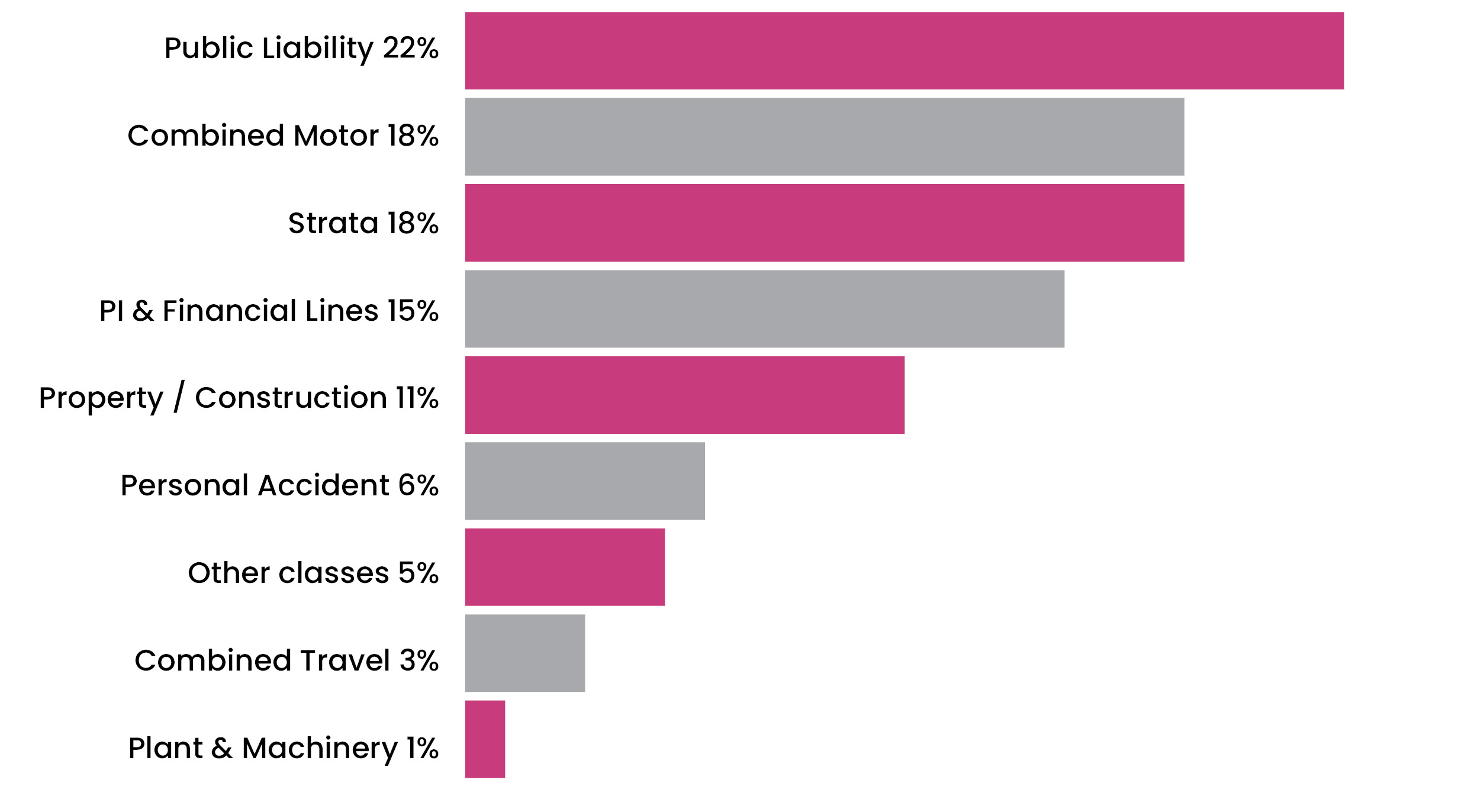

In terms of new notifications for the year 2023, we have seen an overall increase in claims activity. The breakdown across business lines is illustrated in the table below.

Number of claims notifications by policy class, 2023 calendar year (Bellrock Group)

Trends in claims

In terms of claims activity over the past 12 months, there continues to be a significant increase and awareness in terms of Cyber Liability Insurance (see our guide to Cyber Liability Insurance here).

In the Annual Cyber Threat Report 2023, published on 14 November 2023, the ACSC reported that is received over 94,000 cybercrime reports, an increase of 23 per cent from the previous financial year, representing on average a report every 6 minutes (an increase from every 7 minutes previously).

The report comments that Australia’s region, the Indo-Pacific, is also now seeing growing competition on multiple levels, including economic, military, strategic and diplomatic.

Noting the above, Australian governments, critical infrastructure, businesses and households continue to be the target of malicious cyber actors. The report illustrates that both state and non-state actors continue to show the intent and capability to compromise Australia’s networks. It also highlights the added complexity posed by emerging technologies such as artificial intelligence.

As per ACSC data, there has also been a rise in the average cost per cybercrime reported to over $46,000 for small businesses (up from $39,000), $97,200 for medium businesses (up from $88,000), and over $71,600 for large businesses (up from $62,000). An average increase of 14 per cent.

The Top 3 cybercrime types for business were identified as being:

- Email compromise

- Business email compromise (BEC) fraud

- Online banking fraud

According to data published by the Office of the Australian Information Commission (OAIC) on 19 October 2023 (in terms of its Notifiable Data Breaches Report), data breaches were up 5 per cent under the Notifiable Data Breaches scheme, with the top 5 affected sectors being:

- Health Service Providers – 135 data breach notifications

- Finance (including Superannuation) – 120 data breach notifications

- Recruitment Agencies – 68 data breach notifications

- Insurance – 66 data breach notifications

- Legal, Accounting & Management Services – 63 data breach notifications

We also discuss new data published by the OAIC in our article of 12 September 2023, which provides further insight into the evolving landscape of notifiable data breaches sustained by Australian businesses.

There continues to be an increase in “claims frequency” and “claims costs” for strata buildings.

The frequency of claims due to weather events over the last few years, including poor construction practices with newer builds, continues to see the number of claims reported each year increase. Water damage remains the number one source of claims.

In addition to the increased frequency of claims, the post COVID-19 impact on the building industry saw building repair costs surge in 2022. Repairers were reporting significant material delays of up to a month on goods including timber, steel, windows, doors, roof tiles, bricks, electrical equipment and waterproofing insulation. This impact has abated in 2023, where we have seen steady supply returning to the market, with costs beginning to ease.

Aside from claims arising from storm related events throughout the last few years, there has been a notable increase in legal expenses claims in relation to disputes between unit owners and Building Management Committees, as well as Owner’s Corporations. Additional claims have also arisen from renovations to Strata Buildings (including failure to agree planning permission). See our article on this topic here.

We also recently discussed in our article of 9 October 2023, the narrowing of cover on strata insurance policies, which in turn exposes committee members to new liabilities.

Throughout Australia’s construction industry there continues to be increased scrutiny and claims activity. This has become even more challenging in what is a continuing “hard market” environment for construction professionals, in which premiums have increased, limits are being reduced, excesses are rising and there is a general narrowing of cover.

Accurate building replacement values have also never been more critical, with the rise in the cost of construction and high inflation being significant factors.

The significant rise in the cost of construction materials, paired with labour shortages and global instability, continues to impact supply chains. The consequence is that claims and replacement values are increasing and to meet the rise, insurers must deploy more capacity. If declared values are not adjusted appropriately this presents a significant under-insurance risk to policyholders.

As discussed in our article, “The Building Practitioners Act – Implications for Construction Professionals and their insurers in an already hardening insurance market” additional challenges have also emerged in the building industry and consequently onto the insurers of building professionals and practitioners following the introduction of the Design and Building Practitioners Act 2020 (NSW).

As recently discussed in our article “Impending obligations for consultants working in Victoria’s building and construction industry”, legislative changes to the Building Act 1993 (VIC) (the Act), which come into effect on 1 February 2024, will create a new requirement for building practitioners and broaden the scope of professionals that fall within the definition of “building practitioner”. It is vital that practitioners caught by the new amendments carefully consider their roles, responsibilities and insurance requirements prior to commencement of the Act. Failing to do so may give rise to disciplinary action and claims exposure.

“Worker to Worker” claims over the past 12 months also remain an ongoing concern.

Professional Indemnity and Financial Lines claims remain active areas with a notable increase in such claims as:

- Property Management

- EPL Unfair Dismissals

- Claims by regulatory groups

- Claims within the construction industry in terms of developments and product selection, defects and certification

- D&O claims for alleged ASIC and US Regulatory breaches.

As detailed in our article, ASIC v RI Advice, financial services licensees should expect further action from ASIC where there are failings in risk management.

As detailed in our recent article, “The increasing incidence of natural disaster & impacts of COVID-19 on recovery efforts”, and following on from our last market update there has been a continuation in terms increased severity and frequency of major weather events, with the last 24 months seeing a continued onslaught of property claims primarily arising from severe weather and flood.

The most notable events over the past 2 years being the following:

February 2022 (Cat 221): On Monday 28 February 2022, the Insurance Council of Australia (ICA) declared an Insurance Catastrophe for Southeast Queensland and parts of NSW as a result of record breaking severe weather and flooding which occurred between 22 February 2022 and 9 March 2022, with a reported 23 deaths.

Impacts: As at 15 December 2023, a total of over $6.1 billion in insured losses have been incurred to date incorporating 243,000 claims with an average payout of $23,000 with a current closure rate of 88.2%. This is the costliest flood in Australia’s history and fourth most costly disaster overall. The cost is over double that of the 2011 Brisbane flood, which saw $2.3B in insured losses.

July 2022 (SE 222): On 5 July 2022, the ICA declared a “Significant Event” (SE) for the region of New South Wales. Whilst this flooding event most significantly impacted communities surrounding the Hawkesbury and Nepean Rivers, all regions impacted by the flood fell under SE declaration. This was the fourth largest scale flood event for some Western Sydney communities over a two-year period.

Impacts: As per current data, a total of over $285M has been incurred to date, incorporating 23,400 claims, with a current closure rate of 96.2%.

October 2022 (Cat 223): On 19 October 2022, the ICA escalated its significant event declaration to an Insurance Catastrophe for regions of Victoria, Tasmania and NSW impacted by severe weather and flooding since 12 October 2022.

Impacts: As per current data, a total of over $781 million has been incurred to date, incorporating over 22,400 claims, with a current closure rate of 87.8%.

November 2022 (SE 224): On 15 November 2022, the ICA declared a “Significant Event” (SE) for parts of Central West NSW impacted by flooding since 12 November 2022. The impact of the flooding was felt significantly in communities surrounding Central West NSW.

Impacts: As per current data, a total of over $248M has been incurred to date, incorporating over 14,800 claims, with a current closure rate of 92.9%.

May 2023 (SE 231): On 29 May 2023, the ICA declared a “Significant Event” (SE) for the Hunter and Central Coast regions of NSW impacted by hailstorms on 26 May 2023.

Impacts: As per current data, a total of over $309M has been incurred to date, incorporating over 25,600 claims, with a current closure rate of 74.0%.

December 2023 (Cat 232): Tropical Cyclone Jasper made landfall north of Port Douglas on 13 December taking 5 days to move west across Queensland with several areas recording more than 1000mm of rain. The slow speed and heavy rainfall of the cyclone caused extensive flooding. An insurance catastrophe was declared 21 December.

Impacts: Claims data is not yet available.

December 2023 (Cat 233): On 27 December 2023, the ICA declared a “Significant Event” (SE) for areas of Queensland, New South Wales and Victoria impacted by severe storms from 23 December 2023. As the extensive impact of ongoing storms continued over the new year period the ICA escalated its declaration to an Insurance Catastrophe on 29 December extending the declaration to 3 January 2024.

Impacts: Claims data is not yet available.

Data shows that the cost of natural disasters continues to be real and significant. As detailed in the ICA “Insurance Catastrophe Resilience Report 2023”, which was released on 13 September 2023, in 2022 alone there were more than 302,000 disaster related claims lodged from 4 declared insurance events across Australia, with costs of $7.28B in insured losses.

However, as noted by the ICA in their report, there has been respite in terms of catastrophe activity over the past 12 months (from July 2022), which has been significantly less costly for insurers and impacted far less communities. The ICA report notes that Insured losses were just 22 per cent of the previous catastrophe period.

However, any potential respite is unlikely to last, as discussed in our recent article “From floods to fire – El Nino is here”.

Collectively governments, stakeholders and insurers must continue to develop solutions to combat these growing challenges, giving consideration and priority to reducing Greenhouse Gas Emissions and investing in resilience. This can only be done by identifying and adopting policies in the short, medium and long term to alleviate the dangers faced by local communities and the cost of rising insurance premiums.

As discussed in our March 2023 article (What is Social Inflation, and how is it impacting insurance?), ‘Social Inflation’ is becoming more relevant to businesses and their cost of insurance in advanced economies. This especially refers to claims costs rising at a greater rate than general inflation due to societal influence on the absorption of liability.

Regarding COVID-19 related issues, there remains a significant and wider impact on the insurance industry across all insurance products. Whilst most claims have focused on the hospitality and travel sectors, the most notable and well publicised relate to the two Business Interruption “test cases” which were both litigated in the High Court. However, there continues to be wider implications such as potential claims against Directors & Officers and Company Liability in terms of responses to COVID-19, mismanagement of company finances, continuous disclosure, insolvency, unfair dismissal and claims brought by regulatory authorities by way of some examples.

In reality, the aftereffects of COVID-19 continue to impact a broad spectrum of insurance products.

Continue reading our full range of market updates here:

For more in depth market updates by product class, profession and industry, please see our individual reports below: